CFC - Buy @ 4.55, Sell @ 5.68 (24.8% - 14 Mar to 20 Mar)

How you do anything is How you do Everything! This is where I chronicle my journey to my semi-retirement within 365 days, including the methods and strategies, the thoughts and mindset etc!

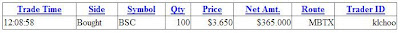

When JP Morgan announced that they would bail Bear Sterns (BSC) at $2 a share, I bought into BSC at $3.65 after the price falls $26 today!

When JP Morgan announced that they would bail Bear Sterns (BSC) at $2 a share, I bought into BSC at $3.65 after the price falls $26 today! THE SKY IS FALLING and here's the time to go in for the killing!

THE SKY IS FALLING and here's the time to go in for the killing!

MER Jan'08 50 Put (MERMJ) - Enter @ 0.70, Exit @ 0.80 (14.3% profit)

MER Jan'08 50 Put (MERMJ) - Enter @ 0.70, Exit @ 0.80 (14.3% profit)

But, I'm into a spread yesterday for S&P 500 (SPX). S&P 500 dived from 1,576 to 1,546 and I'm into this with the weekly options 1,555/1,570 Bull Put Spread. My maximum loss was supposed to be $6,600 and I converted it to a Iron Condor by having another 1,555/1,570 Bear Call Spread to offset the loss towards the last minute. The Bear Call Spread gave me $1,750, making my SPX loss limited to $4,850 (which is still quite high for me!!).

But, I'm into a spread yesterday for S&P 500 (SPX). S&P 500 dived from 1,576 to 1,546 and I'm into this with the weekly options 1,555/1,570 Bull Put Spread. My maximum loss was supposed to be $6,600 and I converted it to a Iron Condor by having another 1,555/1,570 Bear Call Spread to offset the loss towards the last minute. The Bear Call Spread gave me $1,750, making my SPX loss limited to $4,850 (which is still quite high for me!!).

Market Crash!