Merrill Lynch & Co. (MER) recorded its biggest quarterly loss since being founded 94 years ago after the world's largest brokerage took almost $15 billion worth of write-downs from bad subprime mortgage bets.

That caused Merrill Lynch to post a net loss after preferred dividends of $9.91 billion, or $12.01 per share, compared to a profit of $2.3 billion, or $2.41 per share, a year earlier. Analysts—who have had a hard time ascertaining just how steep losses would be for Wall Street banks—had been forecasting a $4.93 per share loss, according to Thomson Financial.

Imagine -$12.01 vs. -$4.93. It's a big earning disappointment! I went into MER put options when the stock price was 51.25 and got out at 50.85 within 45 minutes.

MER Jan'08 50 Put (MERMJ) - Enter @ 0.70, Exit @ 0.80 (14.3% profit)

---

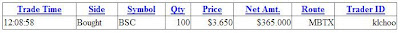

Within the next minute, I also closed another forex trade on EUR/USD.

EUR/USD - Short @ 1.4683, Close @ 1.4678 (5 pips)